maryland local earned income tax credit

And you may qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Chapter 7 discusses earned income tax credit improper payments and the use of refund anticipation products.

Earned Income Tax Credit Eitc Interactive And Resources

2018 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

. Required to file a tax return. On this step you will determine your Adjusted Gross Income AGI by entering your pre-tax income any payroll deductions and Adjustments to Income. Real Property Tax Credit A ten-year tax credit against local real property taxes on a portion of real property expansion renovation or capital improvement.

The local EITC reduces the amount of county tax you owe. All fields are required. Vital Statistics data covering births in Maryland from 1995 to 2004 to examine whether the local EITC impacted birth weight and the probability of low birth weight in Montgomery County.

Maryland residents do not get credit for local tax paid to Maryland municipalities. MORE SUPPORT FOR UNEMPLOYED MARYLANDERS The RELIEF Act will repeal all state and local income taxes on unemployment benefits for tax years 2020 and 2021 helping people get more refunds during. Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. If you are a married couple filing either a joint or separate Maryland return or you have at least one qualifying child then you may claim one-half 50 of the federal credit on your Maryland return. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

IFile 2020 - Help. The state EITC reduces the amount of Maryland tax you owe. Answer a few quick questions about yourself to see if you qualify.

Chapter 8 and 9 assess the fiscal impact of State and local earned income tax credits and provide a comparison of earned income tax credits in other states. The Social Security Administration bases work credits on your total yearly wages or. The credit is equal to 50 of the federal tax credit.

Enclose a copy of your local PA Earned Income Tax return with your MD filing. The earned income tax credit is praised by both parties for lifting people out of poverty. The state EITC reduces the amount of Maryland tax you owe.

New Member June 14 2021 527 PM. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. The amount of credit is 80 of the eligible assessment in each of the first 5 years and the credit deceases 10 annually 70 60 50 40 30 for the subsequent.

New Issue Report Fri 12 Jun 2009. MD EIC and MD local EIC. Does Maryland offer a state Earned Income Tax Credit.

Thelocal EITC reduces the amount of county tax you owe. If you claimed an earned income credit on your federal return or would otherwise have been eligible to claim an earned income credit on your federal return but for you or your spouse filing with an individual taxpayer identification. Individuals filing as single head of household or qualifying widower without a qualifying child.

It is part of your Maryland tax and is added to Form 502 on line 28 as Local Tax. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. Of those roughly 60000 would have qualified for the EITC had they been allowed to claim it.

The chart shown below outlining the 2020 Maryland income tax rates and brackets is for illustrative purposes only. 502LC also calculates a local tax credit for income taxes paid to another state or to a local jurisdiction in another state for tax years 2012-2014. Based on 2019 tax data 86000 people filed taxes using an ITIN.

Some taxpayers may even qualify for a refundable Maryland EITC. These credits can reduce the amount of income tax you owe or increase your income tax refund. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Chapter 10 summarizes the findings of. You must first have worked in jobs covered by Social Security in order to be eligible to apply for Social Security disability benefits. Earned Income Tax Credit EITC Assistant.

Select the tax year you would like to check your EITC eligibility for. For wages and other income earned in. Data on earned income tax credit claimants.

If you earn less than 57000 per year you can get free help preparing your Maryland income tax return through the CASH Campaign. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

If you are not certain if you qualify both the Comptroller of Maryland and the Internal Revenue Service have. Federal tax law prevents filers from receiving the Earned Income Tax Credit if they do not file using a Social Security number which meant they also could not receive. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the size of the states Credit for Child and Dependent Care Expenses expand the income limits and make the credit refundable for single filers with incomes.

33 rows States and Local Governments with Earned Income Tax Credit More In. About 86000 people in Maryland file tax returns without using a. Updated on 4152021 to include changes for Relief Act 2021.

In addition the legislation. Detailed EITC guidance for Tax Year 2021 including annual income thresholds can be found here. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

For the MD EIC2021 MD Instruction book page 19 states. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. 0 2 3300 Reply.

Answer some questions to see if you qualify. Individuals should complete this form to determine if the individual may claim a local tax credit and a recalculated State tax credit on the Maryland return. Some taxpayers may even qualify for a refundable Maryland EITC.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Earned Income Tax Credit Now Available To Seniors Without Dependents

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Earned Income Credit H R Block

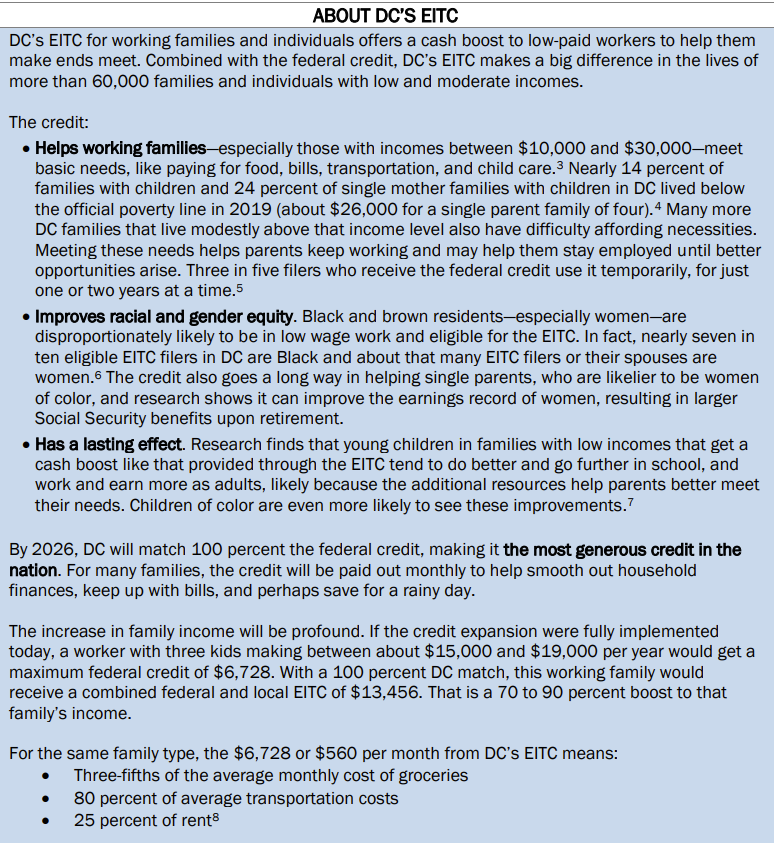

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

How To Receive The Child Tax Credit And Or Earned Income Tax Credit The United Food Commercial Workers International Union The United Food Commercial Workers International Union

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

What Are Marriage Penalties And Bonuses Tax Policy Center

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Irs Child Tax Credit Payments Start July 15

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Summary Of Eitc Letters Notices H R Block

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How Do State Earned Income Tax Credits Work Tax Policy Center