maine tax rates for retirees

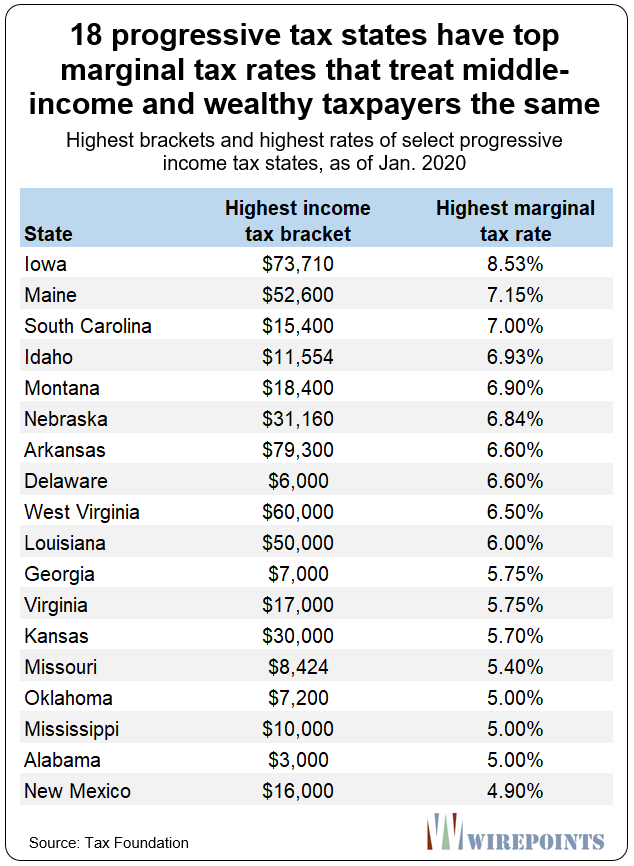

The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022. To find a financial advisor who serves your area try our free online matching tool.

18 Progressive Tax States Have Top Marginal Tax Rates That Treat Middle Income And Wealthy Taxpayers The Same1 Wirepoints

3 A married couple with 50000 in taxable income could therefore realize.

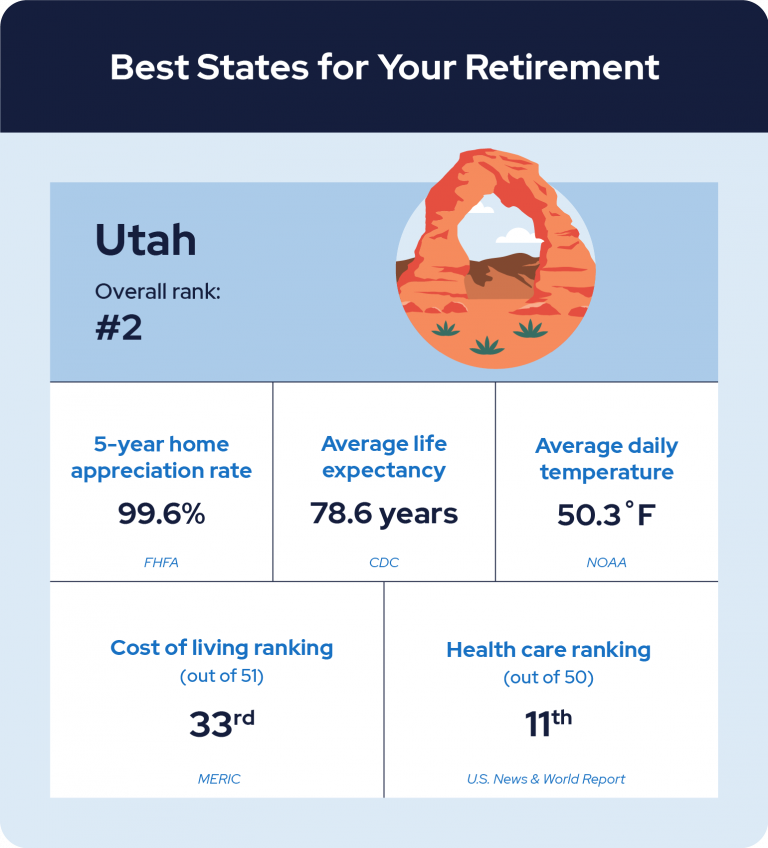

. Is maine a tax friendly state for retirees. One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715. Enter your financial details to calculate your.

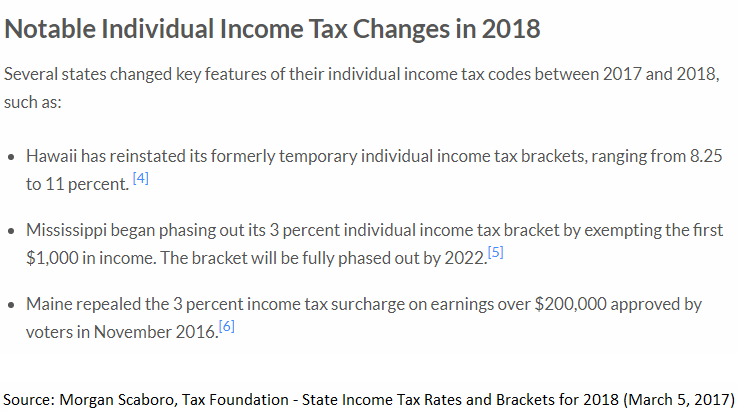

10 Least Tax-Friendly States for Retirees 12 States That Tax Social Security Benefits 14 States That Wont Tax Your Pension 12 States That Wont Tax Your Retirement Income 33 States with. Maines tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. It also has above average property taxes.

Average property tax 607 per 100000 of assessed value 2. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees. With all that in mind here are the top 10 best places to retire in Maine.

Kennebunk is a seaside town with a tax burden of 1570 which is the tax rate of every city on this list. 12 States That Wont Tax Your Retirement Distributions. Some states with low or no income taxes have higher property or sales.

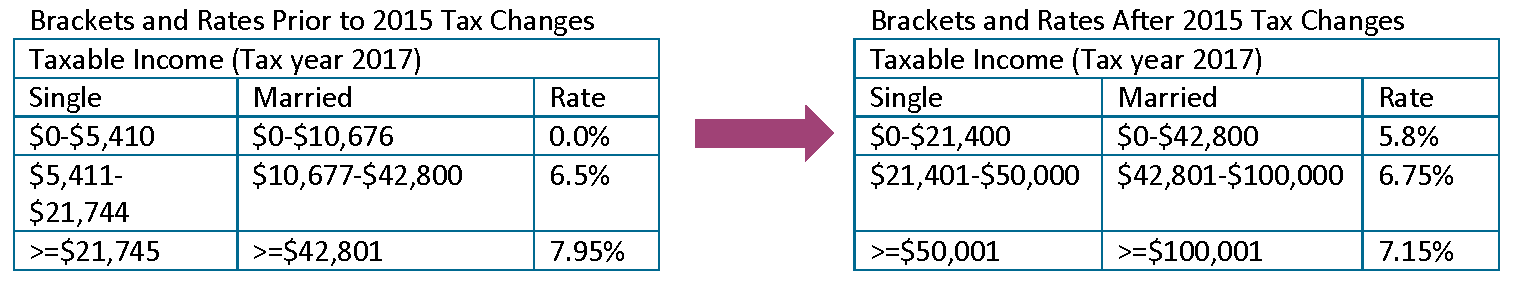

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. However Maines sales tax rate is considerably low at 55. Maine tax rates for retirees Friday August 12 2022 Edit Residents also pay income taxes at a rate of 65 on income between 5200 and 20899 and 795 on income of 20900 or more.

Detailed Maine state income tax rates and brackets are available on this page. 715 on taxable income of 54450 or more for single filers. Although the state does not tax Social Security.

Maine Income Tax Range Low. The rates ranged from 0 to 795 for tax years beginning after. Your 2021 Tax Bracket to See Whats Been Adjusted.

For example WalletHub considered property income and sales and excise taxes when. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. 58 on taxable income less than 23000 for single filers.

Maine Income Taxes The state income tax in Maine is based on just three brackets. Maine has three marginal tax brackets ranging from 58 the lowest maine tax bracket to 715 the highest maine tax bracket. The state income tax is very low starting at 3 percent and stands out as a great place for.

55 The five states with the. Less than 46000 for joint filers High. After Alaska the four states with the lowest combined state and local sales tax rates as of 2021 are.

Some states with low or no income taxes have higher. While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715. Download a sample explanation Form 1099-R and the information.

The tax rates range from 58 on the low end to 715 on the high end. The 20 tax rate applies only to single taxpayers with incomes above 445850 or 501600 for married taxpayers. A states tax burden is the percentage of total income that residents pay on state and local taxes.

Maines income tax rate ranges from 58 to a top marginal rate of 715. They also have higher than average property tax rates.

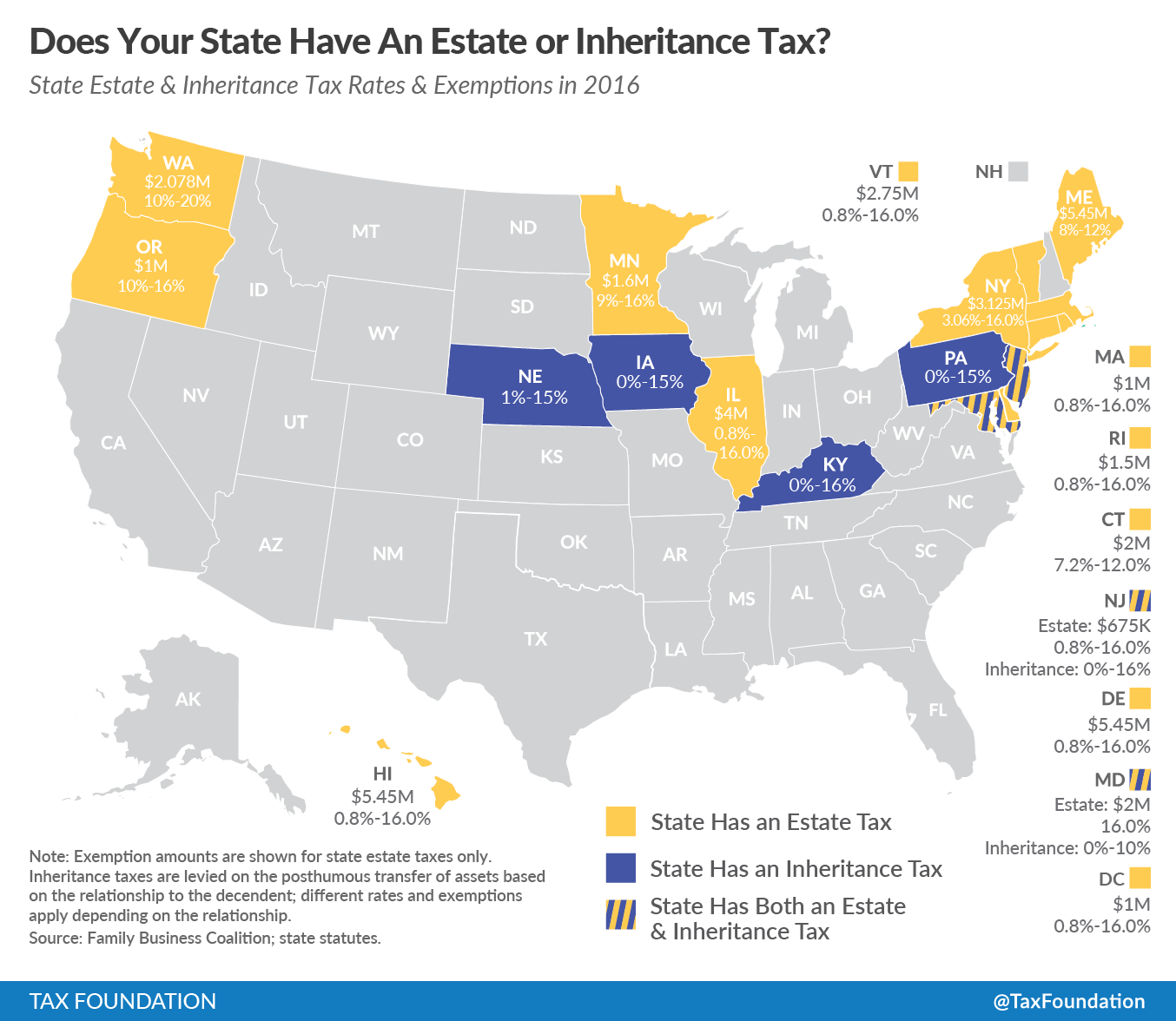

Maine Estate Tax Everything You Need To Know Smartasset

Map How High Is Your Town S Property Tax Rate Press Herald

Maine Retirement Taxes And Economic Factors To Consider

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

How Maine S Personal Income Taxes Work Mecep

Concerned Taxpayers Of Scarborough Maine The Town Of Scarborough Has Now Provided Preliminary Information On The New Tax Rate Or Mil Rate For Next Year And As Most Of You Already

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

![]()

Opinion A Recent History Of Maine S Swiftly Evolving Tax Code Maine Beacon

The Most And Least Tax Friendly Us States

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

10 Most Tax Friendly States For Retirees Kiplinger

State Income Tax Data Updated For 2018 Now Available In Total Moneytree Software

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

![]()

Video New Tax Credit Could Give Maine Workers A Big Boost Maine Beacon