lower average cost stock calculator

If you then bought an additional 100 shares of stock at 995 per share plus a 5 commission your total cost for all your shares would be 2500. Enter the purchase price per share the selling price per share.

Stock Price Calculator For Common Stock Valuation

We value your time.

. If I buy more shares at a lower price what is my new average cost per share Description. Lets stick with your original 100 shares of stock with a cost basis of 2500. Find A Dedicated Financial Advisor.

Lets Partner Through All Of It. The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. To calculate the average price you need to know the total contracts shares quantity and the purchase price of each contract share.

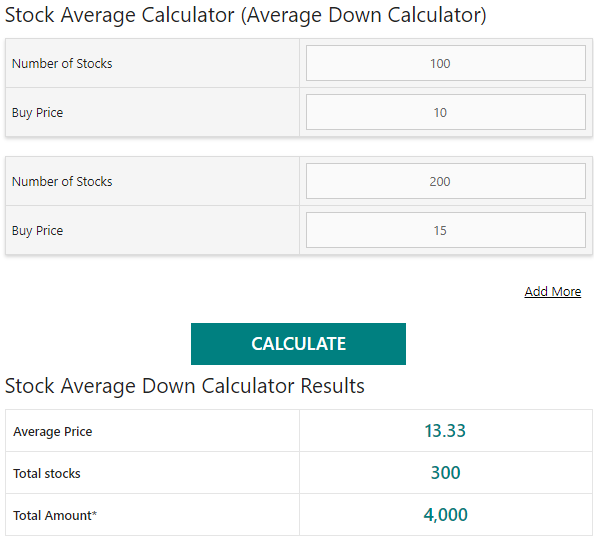

NAV returns assume the reinvestment of all dividend and capital gain distributions at NAV when paid. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. Stock trades at 49 in another six months the investor now has a potential gain of 800 despite the fact that the stock is.

If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will become 1000000 from an initial investment of 600000. The Stock Calculator is very simple to use. Determine Average Share Cost when adding share to existing position.

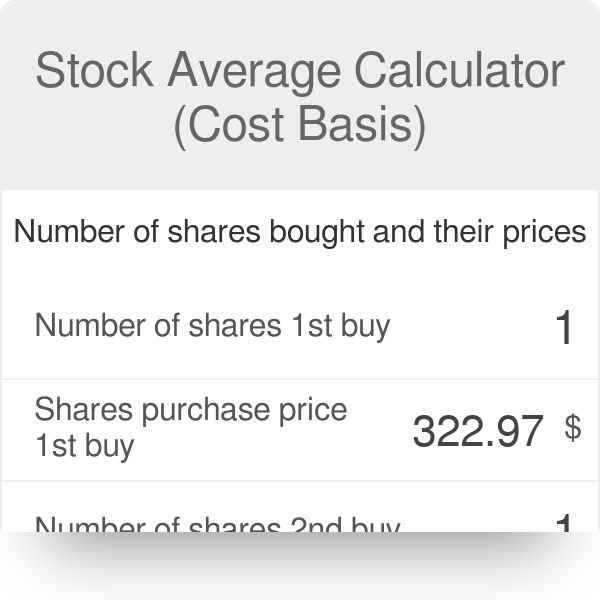

You can also figure out the average purchase price for each investment by dividing the amount invested by the shares bought at each. 100000 100000 200000 contracts. Lets say you want your average to.

Indexes are not supported. Its only based on the price return of your investments including factoring in any commissions or trading fees. Exchanges are also supported.

Then the stock falls to 700 per share. Ad Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. Current performance may be lower or higher than the performance quoted.

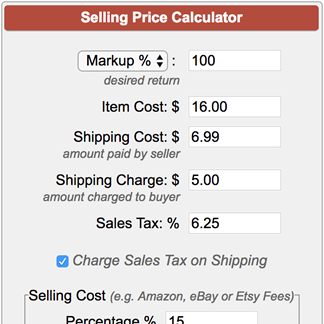

Comparing the costs of the commissions of your agency with other agencies in the market holding onto a stock until it becomes subject to a lower tax brackets. Divide the total amount invested by the total shares bought. It is very simple let me explain to you using an example.

Enter the commission fees for buying and selling stocks. Cost Basis Average cost per share 4858 x of shares sold 5 24290. Find a Dedicated Financial Advisor Now.

I want to buy 100 additional shares at 800 per share. For example the mathematical average of 100 and 200 is 150 but if you bought 10 shares of stock at 100 and only one share at 200 the lower-priced shares carry more weight when calculating. To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858.

Although as you enter subsequent transactions it can become harder to follow. The results are added together and then divided by the total number of occurrences. Lower of Cost and Market Method.

To compute for the average price of the new stocks you just bought you have to compute for the total costs including charges and divide it by the total number of shares bought. Stock exchange and supported by Alpha VantageSome stocks traded on non-US. Volume 0 300000 500000.

The lower of cost and market method is the requirement of GAAP in the United States that inventory be recorded at the lower of either the cost to produce it the. This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000. Life Is For Living.

The formula behind this is simple. Answer 1 of 5. Lets say you buy 10 shares of A for 1000 each.

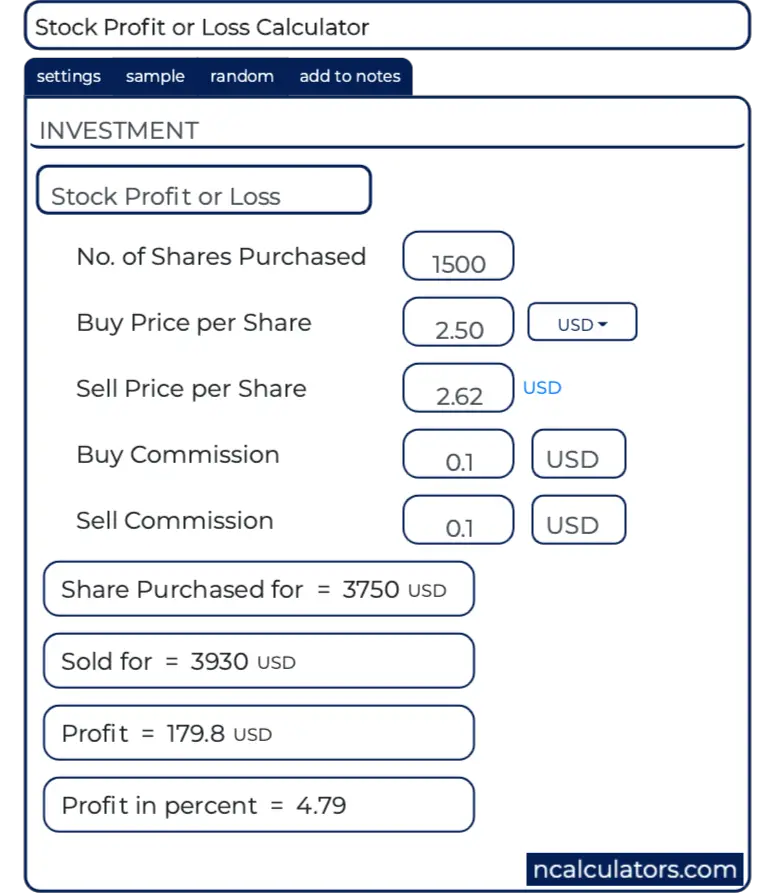

The stock profitloss calculator created by iCalculator will assist you in determining the actual value of the returns on your stock investments. To illustrate how to calculate stock value using the dividend growth model formula if a stock had a current dividend price of 056 and a growth rate of 1300 and your required rate of return was 7200 the following calculation indicates the most you would want to pay for this stock would be 961 per share. Enter the number of shares purchased.

You then buy another 100 shares at 30 per share which lowers your average price to 45 per share. You want to reduce your average cost by buying more shares. Are you busy in trading and dont have time to manage all these calculations.

Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. The time is now. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional.

Averaging Down Prices. Calculator 13Average Down Calculator. The average price is multiplied by the number of times it occurs.

For example if you buy 100 shares at 20 and later buy another 100 shares at 30 your total cost basis is 5000 100 20 100 30. Stocks Under 1 2 5 10. Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share.

Stock calculator is a revolutionary solution to calculate your profit when you tradePlease use the calculator above and fill in the requested details and it will give you the report so you can be worry free. In total you paid 10010 and 1005. Just follow the 5 easy steps below.

Total number of contracts shares bought 1st contract amount 2nd contract amount 3rd contract amount. Note that price return isnt the only type of investment return importantly many stocks ETFs CEFs and ADRs also pay dividends. Backtest dollar-cost averaged investments one-month intervals for any stock exchange-traded fund ETF and mutual fund listed on a major US.

I own 100 shares of ABC stock at an avg. You can average down the price of your stock if you buy more shares when the price has fallen. The total number of shares is 100 times 2 which equals 200.

For example lets say you buy 100 shares at 10 each then you buy another 100 shares at 5. The average adjusted cost basis per share is 25 5000 200 shares. The stock calculator here can help you reason about investments you made in stocks or ETFs.

Indian stock market average calculator. That would be 449000 pesos. If Widget Co.

Net Asset Value NAV returns are based on the prior-day closing NAV value at 4 pm. Ad Do Your Investments Align with Your Goals. For performance information current to the most recent month end please contact us.

It can help you in many more ways like. In my example I bought MEG at 449share for 1000 shares. But you still have to add the total charges incurred.

Average Stock Price Calculator developed by ASP is a free stock average price calculator tool that helps users calculate the average share market price quickly. The difference between net proceeds of the sale and the cost basis in this example indicates a gain of.

Cost Of Living In Dallas Skyline Image Dallas Skyline Houston Skyline

Stock Average Calculator Cost Basis

Common Stock Formula Calculator Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

Visualizing Longevity Risk A Critical Risk Factor For Early Retirement Will Help Understand The Issue And I Early Retirement Retirement Calculator Retirement

Stock Calculator For Calculating Return On Investment From Shares Investing Financial Motivation Make Money Today

Ranked Top 10 Lowest Cost Gold Mines In The World Q1 Gold Mining Mining Company Cost Of Production

Best Stock Average Calculator Average Down Calculator

Stock Profit Or Loss Calculator

Roe Vs Roa Top 7 Differences To Learn With Infographics Stock Trading Strategies Business Valuation Project Finance

Average Formula How To Calculate Average Calculator Excel Template

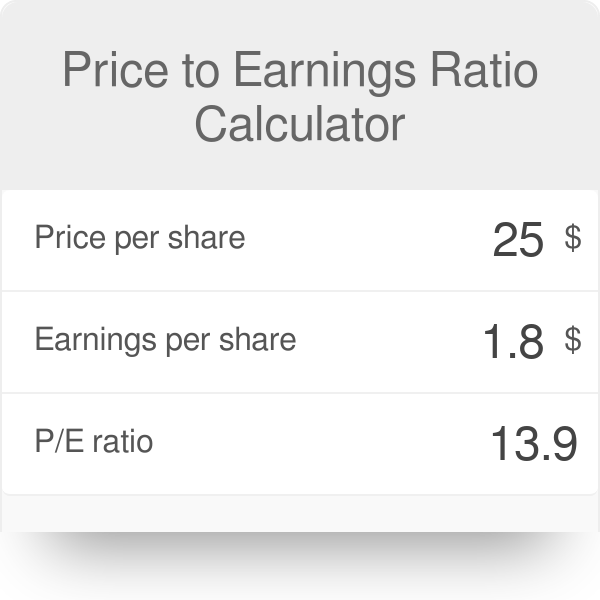

Price Earnings Ratio Calculator What Is P E Ratio

Gbp Usd Aimed Lower From The Levels Around 1 3015 This Week And Slipped Below The 100 And 200 Day Mas In The 1 2960 Area Technical Analysis Gbp Usd Dominant

Stock Average Calculator Cost Basis

Shares Outstanding Formula Calculator Examples With Excel Template

The Low Maintenance Cost Of Using Infrared Saunas Infrared Sauna Sauna Sauna Health Benefits